Investment Giants Set to Reveal Q1 Portfolio Moves: What You Should Know

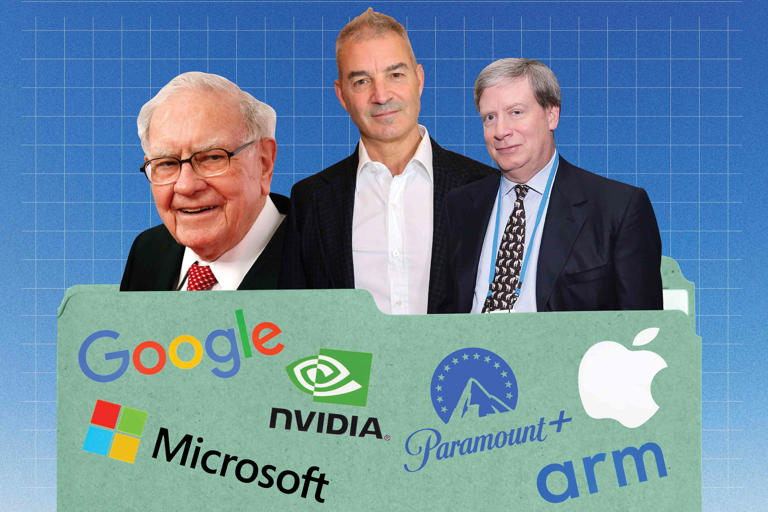

As the deadline for filing 13F forms approaches this Wednesday, investors are eagerly awaiting to see the latest moves from big players like Berkshire Hathaway and Third Point. Berkshire has already hinted at trimming its Apple holdings and exiting its position in Paramount, as it looks to boost its cash reserves. The spotlight is once again on AI, with investors closely monitoring changes in holdings of AI-focused tech firms, chipmakers, and other companies tied to the emerging technology. Nvidia is also on the radar, as it unveils its own investments in stocks like Arm and SoundHound. If you’re looking for investment wisdom, keep a close eye on these filings to see how major investors like Warren Buffett and Dan Loeb have adjusted their equity positions from the start of the year to the end of March.

Remember, however, that these 13F filings only provide a snapshot of portfolios at the end of March and don’t reveal the purchase prices or any subsequent profits or losses. Additionally, they may not accurately represent current portfolios, as trades made after March won’t be reflected in these filings. Stay tuned for potential further changes in Buffett’s portfolio, following his recent adjustments to Apple and Paramount.

Warren Buffett made some notable announcements regarding Berkshire Hathaway’s portfolio at the recent annual shareholders meeting. While the company reduced its stake in Apple for the second consecutive quarter, it still remains their largest stock holding. The value of Berkshire’s Apple position dropped by approximately 22% to $135.4 billion from the end of 2023 to the end of the first quarter, despite Apple’s stock price only declining by about 11% during the same period.

Buffett’s decision to sell Apple shares was driven by his intention to bolster the company’s already substantial cash reserve, which is predicted to exceed $200 billion by the end of the second quarter. Investors will be curious to know if Buffett sold shares of any other companies in the last quarter to further increase their cash pile.

However, Berkshire’s investment in Paramount Global did not turn out as expected, representing a rare mistake for Buffett. During the annual meeting, he admitted that the company sold its entire position in Paramount at a significant loss. Berkshire had acquired 63.3 million shares of Paramount in the first quarter of 2022, but decided to divest from the company by the end of last year.

In a different development, Dan Loeb’s Third Point Capital sold its entire stake in Alphabet (GOOG) (GOOGL) in the fourth quarter of 2023. However, recent reports suggest that Loeb has had a change of heart and is now learning to love Alphabet again, particularly due to its potential in the field of artificial intelligence.

In a recent investor letter, Third Point’s CEO, Daniel Loeb, revealed a “substantial investment” in Alphabet during the first quarter of the year. Loeb believes that Alphabet’s AI capabilities could potentially outweigh any risks posed to its core business. He highlighted that Alphabet has a significant advantage over competitors in terms of distribution and technology, and its AI capabilities can enhance and monetize its entire suite of products. While the size of Loeb’s renewed position in Alphabet remains undisclosed, investors are also eager to learn about other AI-related investments that now make up approximately half of his portfolio. Loeb also increased his holding in Taiwan Semiconductor Manufacturing Co. (TSM) and pointed to legacy tech companies like Microsoft and Amazon as significant players in the AI race. As for Nvidia, opinions among prominent investors vary, with Warren Buffett not holding any shares as of December, while Ray Dalio’s Bridgewater Associates significantly increased its stake in the tech giant. Investors are curious to know if Bridgewater Associates remains bullish on Nvidia or if their stance has changed, similar to Stanley Druckenmiller’s.

According to Druckenmiller, the Duquesne Family Office has decided to sell their Nvidia shares after the stock price more than tripled in 2023. In an interview with CNBC, Druckenmiller mentioned that while the AI trend may be a little overhyped at the moment, he believes it is underhyped in the long term.

However, Nvidia’s significance goes beyond being a mere investment. In its latest 13-F filing, Nvidia disclosed the companies it had invested in during the previous quarter. Notably, Nvidia had positions in several AI-focused firms such as Arm, SoundHound AI, Nanox Imaging, and Recursion Pharmaceuticals. After the disclosure, many of these stocks experienced an increase in their share prices.

Considering Nvidia’s influential role in the AI sector, any changes in its holdings that are revealed in its upcoming 13-F filing could potentially impact the market movements of these companies.