Asian stocks traded within a narrow range on Tuesday, while the dollar weakened ahead of the release of inflation data that is expected to have an impact on global monetary policy.

South Korean and Taiwanese equities saw gains, while US and UK markets were closed on Monday. European shares saw a slight increase in trading. S&P 500 futures also saw a slight rise in early Asian trading.

In the commodities market, gold prices remained stable as traders awaited the release of US inflation data. Oil prices rose as attention turned to the upcoming OPEC+ supply meeting on Sunday and the expected increase in US demand during the summer driving season.

Traders will be closely monitoring inflation data from Australia, Japan, the eurozone, and the US this week. Bank of Japan Governor Kazuo Ueda and his deputy have indicated that there may be room for gradually raising interest rates now that Japan has moved away from a zero inflation norm. Additionally, Japan’s April producer prices exceeded expectations.

The dollar weakened against all major currencies, while the 10-year Treasury yield declined.

On Friday, the Federal Reserve’s preferred measure of underlying inflation is expected to show some relief. Chair Jerome Powell has emphasized the need for more evidence that inflation is on track towards the 2% target before considering policy adjustments. Several US central bankers, including John Williams, Lisa Cook, Neel Kashkari, and Lorie Logan, are scheduled to speak this week.

Chinese property shares rose after Shanghai, a major financial hub, reduced down-payment ratios and the minimum mortgage threshold. This move follows the central government’s support for the property sector, which is now being implemented by larger Chinese cities.

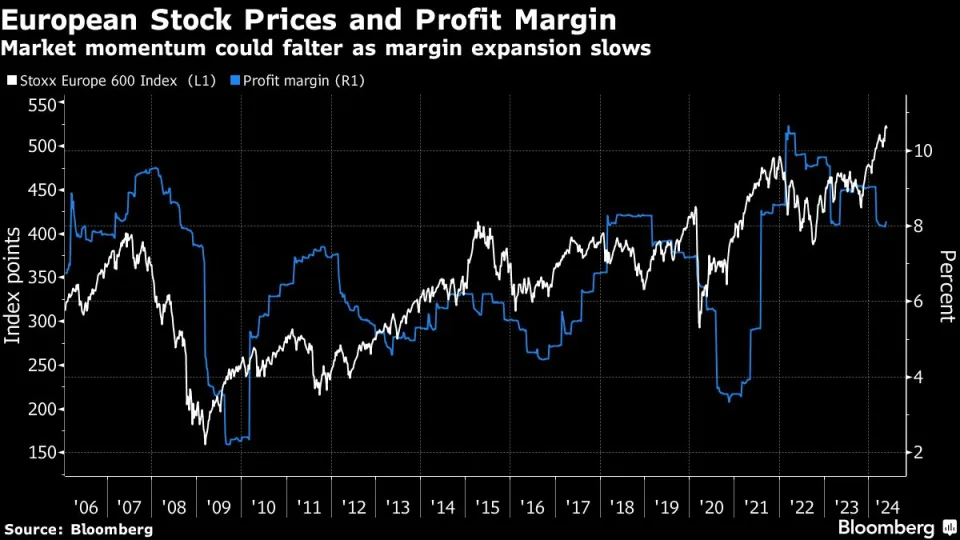

While US and UK markets were closed on Monday, European stocks took center stage. The Stoxx Europe 600 index saw a modest increase led by carmakers and utilities. However, trading volume was lower than the average for this time of day over the past 20 days.

According to Governing Council member Francois Villeroy de Galhau, the European Central Bank (ECB) should consider reducing borrowing costs at both its June and July meetings. Villeroy de Galhau’s statement contradicts the stance of other monetary officials who are hesitant about consecutive rate cuts. Chief Economist Philip Lane also mentioned that the central bank will need to maintain restrictive policies until 2024, even if an interest rate cut is implemented next month.

Although a rate cut in June by the ECB has been widely expected, the subsequent actions are uncertain due to factors such as wage growth and conflicts in the Middle East. Data for this week might reveal a slight increase in headline inflation in the euro region for May.