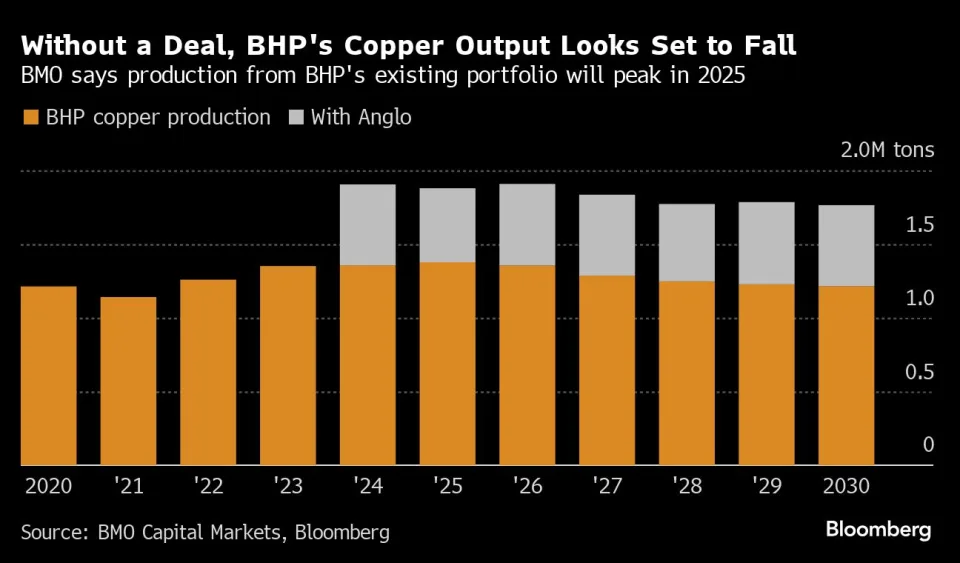

Following BHP Group’s unsuccessful attempt to acquire Anglo American Plc for $49 billion, investors are advising Chief Executive Mike Henry to remain composed. BHP believes that their restraint in the Anglo takeover is commendable, especially considering the mining industry’s history of wasteful spending on disappointing projects and poorly timed acquisitions. The key question now is whether BHP can maintain this discipline, despite the pressure from mining executives to increase copper production, given its status as the most sought-after metal in the energy transition.

According to anonymous sources, BHP’s ambitious plan to become the top global producer of copper through the Anglo tilt has not succeeded. As a result, BHP is now hesitant to pursue further acquisitions in the copper market. This is partly due to the scarcity and high cost of developing major copper deposits, as well as the limited availability of viable acquisition targets. The potential acquisition of Anglo may be reconsidered by BHP in six months’ time, as per the regulations set by the UK Takeover Panel. The sources requested anonymity as these discussions are not public.

According to David Radclyffe, managing director at Global Mining Research, BHP’s portfolio will take time and significant investment to deliver results. This is why they saw an opportunity in acquiring Anglo’s interests in three key assets in Chile. Copper is a highly sought-after commodity, but there are limited assets available and it is challenging to develop them.

The recent battle between BHP and Anglo has captivated the mining sector. It would have been the biggest merger in over a decade and a highly complex one at that. BHP’s proposal required Anglo to divest its South African platinum and iron ore assets before being acquired by the Australian mining giant.

However, Anglo’s board rejected the offers and instead decided to pursue its own turnaround plan.