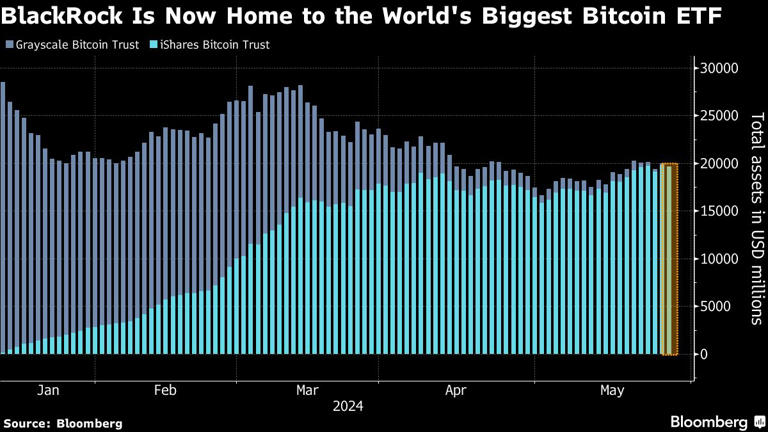

BlackRock Inc.’s iShares Bitcoin Trust has surpassed the Grayscale Bitcoin Trust to become the largest fund for Bitcoin, accumulating nearly $20 billion in total assets since its US listing earlier this year. According to Bloomberg data, the exchange-traded fund held $19.68 billion of Bitcoin on Tuesday, edging out the Grayscale Bitcoin Trust’s $19.65 billion. Fidelity Investments’ offering, with $11.1 billion, is the third largest. The launch of these Bitcoin ETFs, along with others, on January 11 marked a significant moment for the cryptocurrency market, increasing accessibility for investors and fueling a rally that drove Bitcoin to its all-time high of $73,798 in March.

The iShares Bitcoin Trust has seen a significant influx of $16.5 billion since its launch, making it the most attractive investment option. In contrast, investors have withdrawn $17.7 billion from the Grayscale fund during the same period. The higher fees of the Grayscale fund and the departure of arbitragers have been identified as potential reasons for the outflows.

Requests for comment made outside of regular US business hours to both BlackRock and Grayscale Investments LLC have not yet received a response. In March, Grayscale filed for the launch of a clone of its main fund, with expectations of lower fees, according to a reliable source at the time.

The Securities and Exchange Commission, following a court reversal in 2023 prompted by a case from Grayscale, reluctantly approved the first US spot-Bitcoin ETFs in January.

In 2013, the firm launched the Grayscale Bitcoin Trust, which quickly gained recognition as the largest vehicle of its kind. However, shares in this closed-end product sometimes traded at significant premiums or discounts compared to its net asset value. As a result, Grayscale advocated for its conversion into an ETF to ensure trading at the same value.

A Shift by the SEC

Surprisingly, the SEC recently shifted its stance and indicated a willingness to allow ETFs for Ether, the second-largest cryptocurrency by market value, after Bitcoin. This unexpected move comes as the agency, led by Chair Gary Gensler, remains skeptical of the overall crypto industry due to recent scandals.

The group of Bitcoin funds, which currently hold $58.5 billion in assets, has been hailed as one of the most successful new categories of ETFs. However, critics argue that volatile digital assets are not suitable for widespread adoption, even within ETFs.

As an editor of financial articles for our website, I possess a comprehensive understanding of the economic landscape, market trends, and financial policies. I am adept at accurately analyzing relevant information such as company financial statements and stock transaction data. Additionally, I stay abreast of international financial trends, changes in monetary policies, and other global factors. With a strong ability for logical thinking and data analysis, I am skilled at presenting rigorous, objective, and accurate information. My writing ability and news sensitivity allow me to convey complex knowledge in a concise and clear manner.