It’s going to be a long summer for the stock market

The stickiest part of the inflation story is still sticky: Chart of the Week

The stickiest part of the inflation story is still sticky: Chart of the Week

3 Cheap Mid-Cap Stocks That Will Make Early Investors Filthy Rich

Investing in cheap mid-cap stocks can be a lucrative opportunity for early investors looking for substantial returns. These stocks, which are often overlooked, have the potential to yield significant profits. Here are three cheap mid-cap stocks that could make investors filthy rich:

1. Company A: This mid-cap stock is currently trading at a bargain price but has immense growth potential. The company operates in a fast-growing industry and has a strong track record of delivering solid financial performance. With a robust business model and a competent management team, this stock has the potential to multiply investors’ wealth in the coming years.

2. Company B: Despite being a mid-cap stock, Company B has been consistently outperforming its competitors. The company has a unique product or service offering that sets it apart in the market. With a strong market position and a proven ability to generate substantial revenue growth, this stock is poised for significant future gains.

3. Company C: This mid-cap stock is a hidden gem waiting to be discovered. The company operates in an industry with high growth potential and has a solid competitive advantage. With a strong balance sheet and a history of consistently delivering strong financial results, this stock has the potential to generate substantial returns for early investors.

It’s important to note that investing in mid-cap stocks comes with risks, as their market capitalization makes them more volatile than large-cap stocks. However, by conducting thorough research and understanding the companies’ fundamentals, investors can identify cheap mid-cap stocks that have the potential to make them filthy rich.

Investing in mid-cap stocks can be a smart move for investors looking to build long-term wealth. These companies, valued between $2 billion and $10 billion, offer a unique combination of growth potential and affordability. Compared to larger companies, mid-cap stocks often have more room to expand and innovate, which can lead to exceptional returns over time. However, investing in mid-caps does come with some risk, so it’s important to do thorough research before making any investment decisions.

Sterling Infrastructure (STRL) is a mid-cap stock that focuses on infrastructure development in the United States. With a strong backlog of projects and a diversified portfolio, the company is poised for growth in 2024.

Sterling Infrastructure, a company with a long history but relatively low stock market visibility, is poised for a change in fortune. Despite struggling to turn a profit in the past, the company achieved record earnings in the fiscal year 2023. Encouragingly, management has expressed confidence in their performance for the year ahead, maintaining a positive outlook. Additionally, the company’s backlog of projects is rapidly expanding, reflecting the ongoing strong demand for infrastructure solutions.

In the latest financial report of Science Applications International (SAIC), the company showcased positive performance in Q1 FY24. The revenue for the quarter reached $1.8 billion, reflecting a 9% increase compared to the previous year. The earnings per share (EPS) also grew by 56% to $1.00 per share. Additionally, SAIC generated $50 million in cash flow from operations.

SAIC’s strong performance can be attributed to its record backlog, which reached $2.35 billion. This growth is mainly driven by robust demand in the data center and aviation markets.

Looking ahead, SAIC provided a positive outlook for the future, with strong revenue and adjusted EBITDA guidance for 2024. As a result, SAIC stock is considered one of the top cheap mid-cap stocks to buy at the moment.

Science Applications International (SAIC) has emerged as an attractive investment option in 2024. The company reported robust financial results for the fiscal year 2024 in March, and its updated guidance for fiscal year 2025 indicates further growth in revenue and free cash flow (FCF) generation.

SAIC, listed on the NASDAQ under the ticker symbol SAIC, is a mid-cap stock that offers potential for investors seeking value at a reasonable price. The company’s strong performance in the previous fiscal year has bolstered its prospects, making it a top choice among inexpensive mid-cap stocks.

In its latest financial report, SAIC demonstrated its ability to deliver solid results. The company’s management has also provided an optimistic outlook for fiscal year 2025, indicating confidence in its future performance.

Investors should take note of SAIC’s positive revenue trajectory. The company expects its top line to grow, which is a promising sign for investors. Additionally, SAIC’s updated guidance indicates the potential for increased FCF generation, further enhancing its investment appeal.

With its solid financial performance, optimistic outlook, and potential for growth, Science Applications International (SAIC) is positioned as one of the best cheap mid-cap stocks to consider in 2024.

to $7.6 billion due to the completion of certain programs, but the company still managed to beat earnings estimates with EPS of $3.67.

SAIC’s success can be attributed to its strong position in the government contracting sector. The company has a long history of working with government agencies, particularly in the defense and intelligence sectors. This has allowed SAIC to build a reputation for providing reliable and innovative solutions to its clients.

One area where SAIC has excelled is in the field of cybersecurity. With an increasing number of cyber threats facing government agencies and businesses, SAIC has positioned itself as a leader in this space. The company offers a range of cybersecurity solutions, including threat intelligence, incident response, and vulnerability assessments.

In addition to cybersecurity, SAIC also provides software solutions for mission support analytics. This includes tools and technologies that help government agencies analyze data to make informed decisions. SAIC’s expertise in this area has made it a valuable partner for government agencies looking to improve their operational efficiency.

Looking ahead, SAIC is well-positioned to continue its growth trajectory. The company has a strong pipeline of government contracts and is actively pursuing new opportunities. Additionally, SAIC’s focus on cybersecurity and mission support analytics puts it at the forefront of two areas that are expected to see continued growth in the coming years.

Overall, SAIC’s strong financial performance and its expertise in key areas have positioned it as a leader in the government contracting sector. With a solid track record and a focus on emerging technologies, SAIC is well-equipped to continue delivering value to its shareholders in the future.

ACM Research (ACMR), a leading provider of wafer cleaning technologies, reported impressive financial results for the fiscal year 2024. The company’s revenue grew by 40% year-over-year (YOY) to reach $7.4 billion, showcasing their strong performance in the market.

What’s even more impressive is the increase in earnings per share (EPS), which soared by 65% YOY to $8.88 per share. This indicates that ACMR’s profitability is on the rise, reflecting their efficient operations and ability to generate higher profits.

ACMR’s backlog at the end of fiscal 2024 stood at $22.8 billion, out of which $3.5 billion was funded. This backlog provides a solid foundation for continued growth in the upcoming fiscal year of 2025. It suggests that the company has a significant number of orders in the pipeline, which bodes well for their future revenue and earnings.

Overall, ACM Research’s strong financial performance, with substantial revenue growth, increased EPS, and a robust backlog, positions them favorably for continued growth and success in the coming years.

ACM Research (NASDAQ:ACMR), a company that specializes in semiconductor cleaning equipment, is in a prime position to take advantage of the booming global semiconductor industry. As the demand for electronic devices and AI continues to rise, the need for advanced semiconductor chips is also increasing.

ACM Research’s cutting-edge equipment is crucial in the manufacturing process of these chips, making the company an essential player in the industry. With the semiconductor sector experiencing rapid growth, investors may see potential in ACM Research as a promising investment opportunity.

For more information on how to invest in stocks, check out the related video “The Easy Math Behind Investing in Stocks” by Money Talks News.

The 2024 fiscal year is expected to see rapid growth in various sectors, driven by several positive factors. One of the main drivers is the rebound in the semiconductor equipment market. After a period of slowdown, the market is expected to pick up pace, leading to increased demand for semiconductor equipment.

Another factor contributing to the growth is the rising demand for artificial intelligence (AI) applications. AI technology has been rapidly advancing and finding applications in various industries, including healthcare, finance, and manufacturing. This increased demand for AI applications is expected to drive growth in the coming fiscal year.

Overall, these positive tailwinds suggest that the 2024 fiscal year will see continued rapid growth, particularly in the semiconductor equipment market and the AI sector.

year, ACM Research is poised for continued growth in the semiconductor industry.

ACM Research’s impressive Q1 FY24 results reflect the increasing demand for their advanced wafer cleaning technology. The company achieved a remarkable revenue growth of over 100% compared to the same period last year, reaching $152 million. This surge in revenue was accompanied by a substantial increase in earnings per share, which rose by 136% to 26 cents.

The surge in revenue and earnings can be attributed to the company’s expanded product offerings, which led to a 175% increase in total shipments during the first quarter. ACM Research’s ability to meet the growing demand for semiconductor wafer cleaning has positioned them as a key player in the industry.

Looking ahead, ACM Research is well-positioned for further success in the 2024 fiscal year. The company’s strong outlook and robust financial performance indicate a positive trajectory for growth. As the semiconductor industry continues to expand, ACM Research’s advanced technology and efficient cleaning solutions are likely to be in high demand.

With their record-breaking earnings and impressive growth, ACM Research is demonstrating its ability to capitalize on the booming semiconductor market. Investors and industry experts will undoubtedly be keeping a close eye on the company as it continues to make strides in the field of wafer cleaning technology.

ACMR stock is expected to continue its upward trajectory in 2021, thanks to the favorable growth conditions in the semiconductor industry. As the year progresses, ACMR is likely to benefit from these positive tailwinds.

It’s important to note that as of the date of publication, Terel Miles, the writer of this article, did not have any positions in the securities mentioned. The opinions expressed in this article are solely those of the writer and are subject to the InvestorPlace.com Publishing Guidelines.

Miami home values are heating up in these ZIP codes

Miami home values are heating up in these ZIP codes

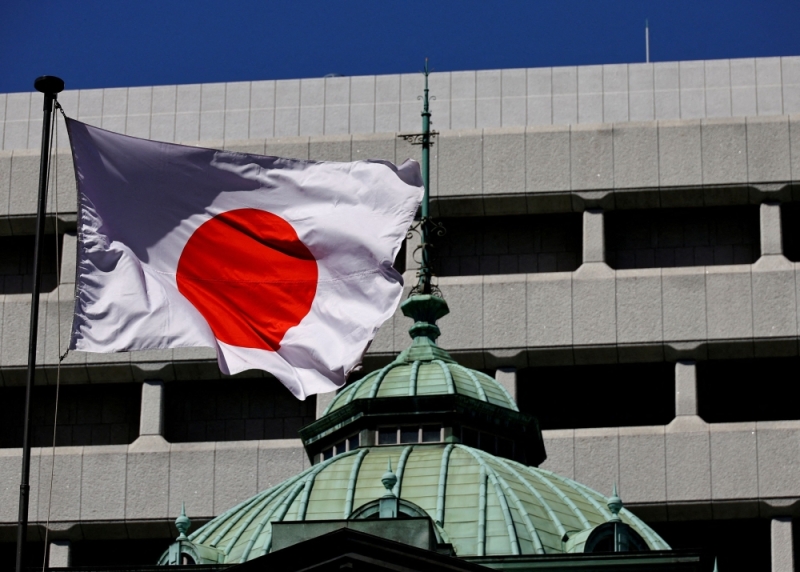

Bank of Japan in no rush to sell risky asset holdings

Bank of Japan in no rush to sell risky asset holdings

Investors pour money into stocks, bonds as inflation worries ebb – BofA says

Investors pour money into stocks, bonds as inflation worries ebb – BofA says