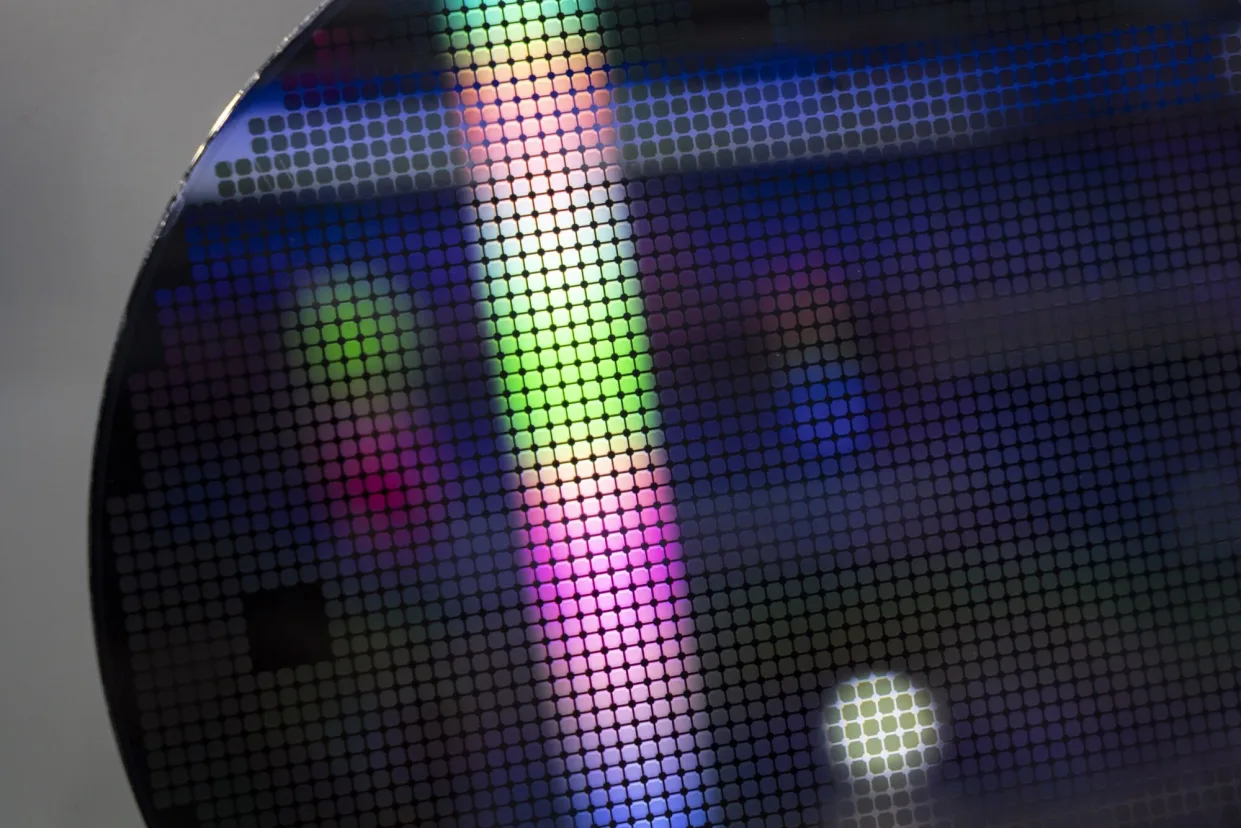

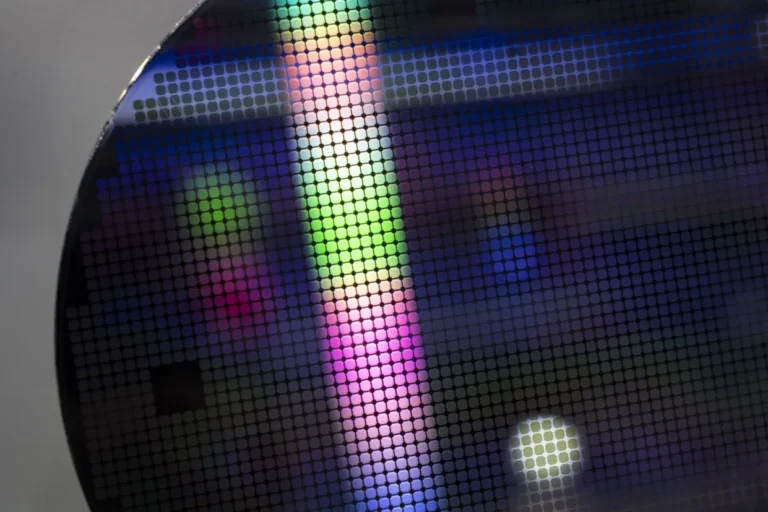

China has established the largest semiconductor investment fund in the country’s history, aiming to boost the development of the domestic chip industry. This move comes as Beijing strives for self-sufficiency in response to the US’s efforts to limit its growth.

According to Tianyancha, an online platform that compiles official company registration information, the third phase of the National Integrated Circuit Industry Investment Fund has raised a total of 344 billion yuan ($47.5 billion) from the central government, state-owned banks, and enterprises, including Industrial & Commercial Bank of China Ltd. The fund was officially established on May 24th.

The latest investment vehicle, referred to as Big Fund III, highlights the Chinese government’s renewed effort to develop its own semiconductor industry amidst escalating tensions with the US. In response to the Biden administration’s significant restrictions on China’s access to advanced chips and chipmaking equipment, China is now encouraging its allies, such as the Netherlands, Germany, South Korea, and Japan, to further tighten export controls and limit China’s access to these technologies.

As a result, major chip stocks in China experienced a surge in share prices on Monday. Semiconductor Manufacturing International Corp., China’s largest chipmaker, saw its shares rise by as much as 8.1% in Hong Kong, while Hua Hong Semiconductor Ltd., a smaller competitor, experienced a more significant increase of over 10%.

The latest fund’s largest shareholder is the Ministry of Finance of China, with investment firms owned by local governments in Shenzhen and Beijing also participating. The Shenzhen government has been providing support for chipmaking plants in Guangdong province, aiming to alleviate the impact of US sanctions on Huawei Technologies Co. by ensuring a stable supply of semiconductor components.

In a global competition for chip dominance, major powers such as the US and European Union have allocated nearly $81 billion towards the production of next-generation semiconductors. The Biden administration’s 2022 Chips and Science Act includes $39 billion in grants for chipmakers, along with $75 billion in loans and guarantees.

This new arms race revolves around computer chips, as they have become a crucial weapon in the technological battlefield.

China has long been known for its proactive industrial policy, which includes the ambitious Made in China 2025 program. This program outlines China’s development goals in areas such as biotechnology, electric vehicles, and semiconductors. Since its unveiling in 2015, China has been a major supporter of the semiconductor sector and has used state capital to fund local chipmakers like SMIC.

Around a decade ago, the national chip fund was established with approximately 100 billion yuan in investable capital. Shortly after assuming the presidency, Xi Jinping initiated a significant overhaul of China’s manufacturing industry, with a focus on advanced technologies ranging from robotics to cutting-edge chip manufacturing.

In 2019, China significantly increased the funding for the Big Fund II, reflecting the escalating competition with the US in the technology sector during the Trump administration. The additional capital was allocated to support promising chip projects in China, including the establishment of new factories by SMIC and the development of chipmaking machines by Advanced Micro-Fabrication Equipment Inc. However, despite Beijing’s substantial investments, the country’s leadership has been disappointed by the prolonged inability to create semiconductors that can replace those from the US. Moreover, the former head of the Big Fund was removed from his position and investigated on corruption charges.

The Biden administration has implemented unprecedented measures to impede China’s technological advancements, citing national security concerns. In the past couple of years, the US has restricted China’s access to cutting-edge chips from Nvidia Corp., crucial for AI model training, as well as the most advanced chipmaking machinery from companies like ASML Holding NV and Applied Materials Inc.

In response, China has escalated its investments in less advanced chip manufacturing capabilities, commonly referred to as legacy chips. The country is currently establishing a network of chip companies centered around its national champion, Huawei, with the aim of achieving breakthroughs in advanced chip development and manufacturing. The recently established Big Fund III may provide financial support for these projects.

–Assistance provided by Jessica Sui.