China’s housing market continued to decline in May, leading to calls for the government to inject cash and credit into the economy. Additionally, industrial output fell short of expectations, threatening China’s growth trajectory. Despite a slight uptick in retail sales, Chinese consumers have yet to fully regain their pre-pandemic spending habits. The property market’s negative performance, including declines in real estate investment and home prices, remains a significant obstacle to China’s economic growth.

According to most economists, the current numbers indicate a weak recovery, which may require additional action from Beijing in order to achieve the 5% growth target for this year. This could involve increased government spending and greater efforts by the central bank to stabilize the housing market and improve access to credit.

One of the most disappointing aspects of the data from May is the lack of improvement in property sales, despite numerous supportive measures. Jacqueline Rong, chief China economist at BNP Paribas SA, suggests that the authorities need to find ways to lower interest rates on existing mortgages, narrowing the gap with the rates on new mortgages.

The People’s Bank of China decided to keep a key interest rate unchanged for the tenth consecutive month on Monday. Economists believe that the bank’s ability to cut rates is limited due to the need to support the yuan, which is facing downward pressure as the US Federal Reserve maintains its high-for-longer stance.

According to Bloomberg Economics, policy support could have a significant impact, but the People’s Bank of China’s focus on currency stability has prevented it from cutting interest rates, at least until the Federal Reserve takes action. Therefore, the main support will have to come from recent policies aimed at aiding the property market and increasing government spending on large-scale investments.

As a result, Chinese stocks experienced a decline, with the onshore benchmark CSI 300 Index closing 0.2% lower. Additionally, a gauge of Chinese developers’ shares fell 3.2% as of 3:08 p.m. local time.

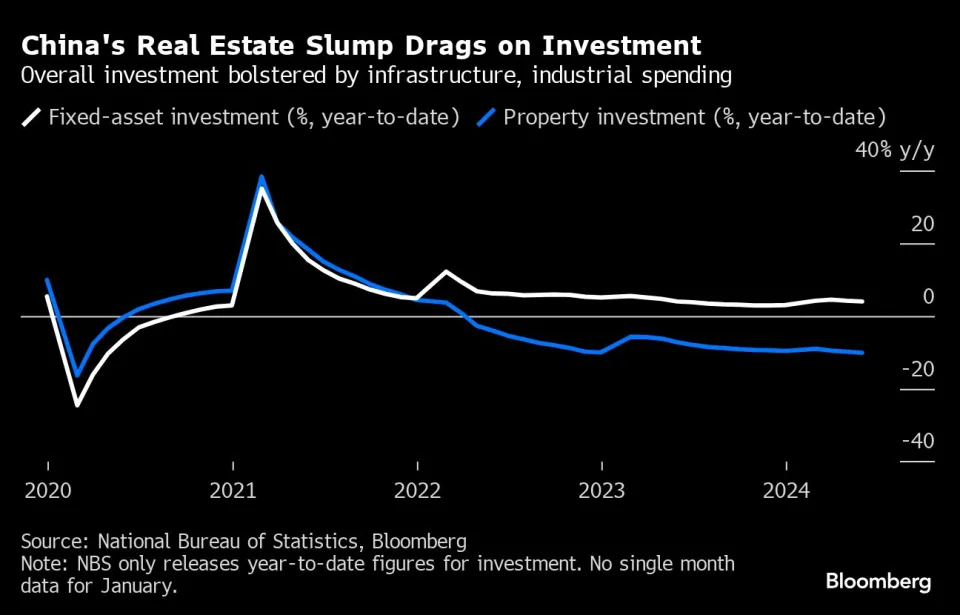

In January-May, fixed-asset investment saw a 4% increase, which is slightly lower than the 4.2% growth in the first four months. This is despite the government issuing more bonds to support infrastructure spending.

Economists, including Larry Hu from Macquarie Capital Ltd., noted that China’s growth is still uneven, with exports and new energy-related capital expenditure driving growth, while consumption and the property sector are lagging behind. However, the slowdown is not severe enough to jeopardize the growth target, and policymakers are not under urgent pressure to implement major stimulus measures.

There has been a slight improvement in retail sales, marking the first acceleration since November. However, the growth rate of 3.7% is still significantly lower than the pre-pandemic level of around 8%, despite the return to normal social and economic activities.

According to Michelle Lam, an economist at Societe Generale SA, the sustainability of the improved momentum in retail sales remains uncertain. China has shifted towards export-led growth as households have been hesitant to spend. The factory boom has helped offset the housing slump and maintained economic growth. However, this strategy is facing uncertainties as major trading partners impose trade barriers that threaten the export engine. The recent imposition of hefty tariffs on Chinese electric cars by the EU, following the US, is one example. Some analysts, like BNP’s Rong, are not overly concerned about the impact. The shipments of electric vehicles from China to the EU only account for 0.4% of the country’s total exports, and the higher selling price in Europe allows automakers to absorb the charges. BNP’s Rong expects the tariffs to only reduce China’s export growth by 0.1 percentage point this year.

In an effort to stimulate domestic demand, China implemented a program in April that provides incentives for businesses and households to upgrade their old machinery. As part of this initiative, the government offers subsidies to buyers of new cars.

However, recent data indicates that the impact of this program has been limited. Retail sales of automobiles in May showed a decline of 4.4% compared to the previous year, indicating only a slight improvement from the previous month.

To address the credit crisis faced by major real estate developers, China recently introduced a comprehensive rescue package aimed at boosting housing sales. This package includes relaxed mortgage rules and encourages local governments to purchase unsold homes. Despite these measures, many experts and investors have expressed concerns that the financial incentives provided may not be sufficient, and trial programs in various cities have demonstrated slow progress.

The combination of weak domestic demand and a challenging foreign-trade environment is causing business confidence to decline. This is leading companies to hesitate in making investments and prompting some to relocate their production overseas. Additionally, credit growth has been sluggish and the M1 money supply indicator experienced its largest contraction in May since data has been recorded dating back to 1996.

According to a survey conducted by UBS Group AG, which included responses from over 400 top executives in mid-May, firms expressed less optimism regarding orders, revenue, and profit margins compared to the same period in 2023. Furthermore, there was a decrease in the proportion of respondents who intend to increase capital expenditure in the second half of this year.

Helen Qiao, the chief Greater China economist at Bank of America Global Research, emphasized the need for additional stimulus to support the economy. Without it, there is a risk of a significant weakening in growth momentum.

–Assistance provided by Yujing Liu and Lucille Liu.