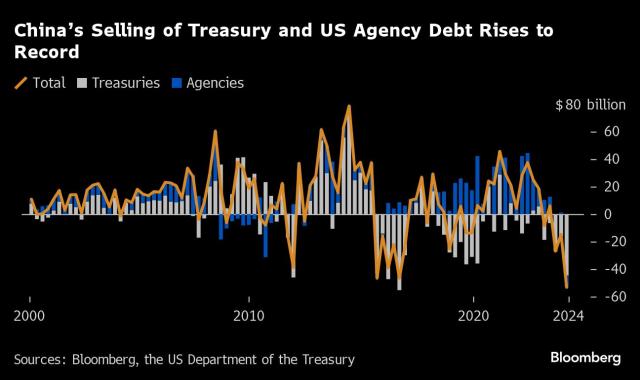

China sold a record amount of US Treasury and agency bonds in the first quarter as it looks to diversify its holdings amid ongoing trade tensions with the US. This move reflects China’s strategy of reducing its exposure to American assets.

China and Belgium have sold a significant amount of US Treasury bonds in the first quarter of this year. China sold $53.3 billion, while Belgium sold $22 billion.

China’s investments in the US are getting more attention as tensions between the two countries escalate. President Biden has announced higher tariffs on Chinese imports, and former President Trump has threatened even higher levies if he is reelected.

According to Stephen Chiu, a chief Asia foreign-exchange and rates strategist at Bloomberg Intelligence, China’s recent selling of US securities suggests a clear intention to diversify away from US dollar holdings. Chiu also believes that if the US-China trade war resumes, especially if Trump returns as president, China’s selling of US securities could accelerate.

China’s holdings of gold in its official reserves have increased as the country sells off dollar assets. In April, the share of gold in China’s reserves reached 4.9%, the highest level since 2015, according to central bank data.

According to Gita Gopinath, the first deputy managing director of the International Monetary Fund, China and its close allies have been increasing their holdings of gold in foreign-exchange reserves since 2015. In contrast, countries in the US bloc have kept their holdings of gold stable during the same period. Gopinath suggests that the increase in gold purchases by some central banks may be driven by concerns about the risk of sanctions.