China’s e-commerce giants are going all out to attract shoppers during the annual “618” shopping festival. Companies like Alibaba, ByteDance, and PDD Holdings are offering steep discounts and enlisting A-list celebrities to promote their products through live videos. They are also ensuring customer satisfaction by offering no-questions-asked returns. Celebrity endorsements and innovative marketing strategies, such as creating digital avatars of founders, are being used to entice consumers.

“The 618 shopping festival this year is the most fiercely competitive ever,” stated Sherri He, managing director at Kearney China. “Ecommerce platforms are facing immense pressure to deliver strong performance amidst a decline in consumer spending.”

The 618 gala this year, which is valued at $100 billion and several times larger than a typical Black Friday event, is garnering more attention than ever before. Both established players like Alibaba and newcomers like Bilibili and ByteDance’s Douyin are offering aggressive discounts and engaging in unprecedented marketing efforts, highlighting the urgency to reignite growth.

The entire ecosystem is feeling the strain. For investors, the 618 festival represents the first significant test in 2024 to determine if Chinese consumers are ready to indulge in spending once again. It also serves as an indicator of how much a property crisis, persistent deflation, and uncertain job prospects are dampening consumer confidence. Ultimately, the performance of Alibaba and JD will likely be crucial in reviving stock prices, which currently stand at only a quarter of their 2020 peaks.

Vey-Sern Ling, a managing director at Union Bancaire Privee, stated that the market is eagerly seeking data to confirm or challenge the narrative of a consumption recovery in China. This year’s “618” event holds particular significance as investors are keen to identify any turning points.

The timeline for the release of final results from companies remains uncertain, as well as the extent of the information provided. Preliminary estimates and independent analysis present a mixed outlook.

JD.com reported a record-breaking gross merchandise value, while Alibaba revealed that over 36,000 brands, including Burberry and Ralph Lauren, doubled their GMV compared to last year’s event. However, Alibaba did not disclose overall figures.

According to market tracker Syntun, total sales on ecommerce platforms decreased by 7% compared to the previous year, reaching 742.8 billion yuan ($102 billion). However, data from Analysys tells a different story, showing that short-video platforms experienced significant growth during the first two weeks of the festival. Douyin saw a 30% increase in sales, while Kuaishou Technology improved by 18%, surpassing Alibaba’s 15% and JD.com’s 9.5% growth.

One possible explanation for this discrepancy could be the rise in no-quibble returns. Luxury brands, in particular, reported exceptionally high return or cancellation rates during last November’s Singles’ Day festival, with some reaching as high as 75%, well above the industry average. In response to the fear of unsold inventory, these brands have slashed prices by up to 50% this year.

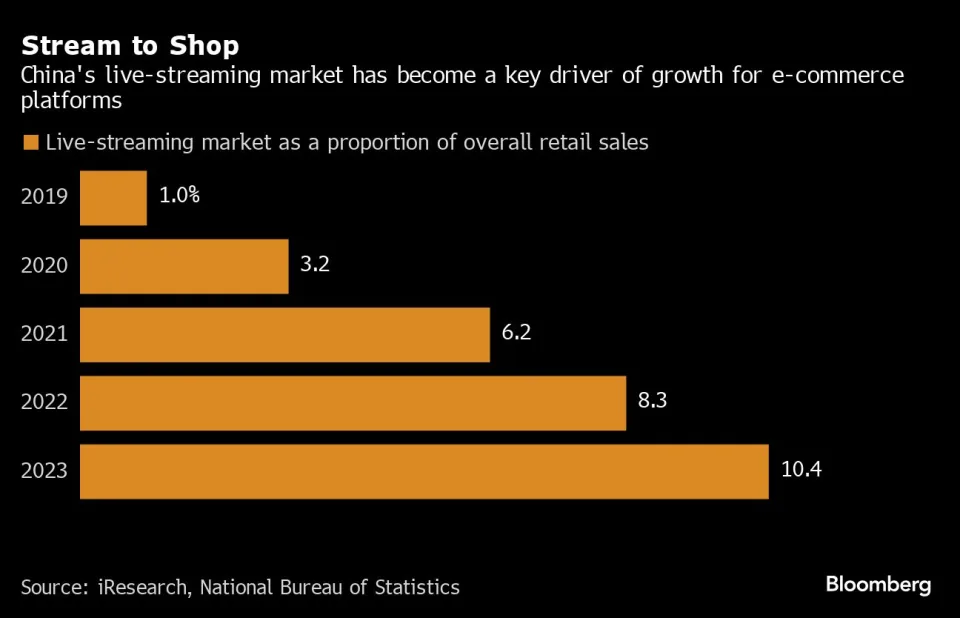

Alibaba CEO Eddie Wu is leading the 618 gala for the first time, as the company aims to refocus on its core online retail strengths and break away from a period of slow growth. Under Wu’s leadership, Alibaba has made significant investments in livestreaming, which is the fastest-growing segment in ecommerce. However, competitors such as ByteDance, JD, and Kuaishou are also entering this space. Data from iResearch and national statistics show that over 10% of China’s retail purchases last year were made through influencer streams.

“According to Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management, the market is expected to react positively to Alibaba’s core ecommerce experiencing a re-acceleration in topline growth. However, investors now view Alibaba more as a value stock rather than a growth stock, so they will closely evaluate the quality, margin, and sustainability of this growth.

Meanwhile, JD.com has pledged one billion yuan to support livestreaming sellers, while Alibaba has promised billions in cash rewards and has experimented with unique approaches such as a streaming section exclusively for company CEOs.

However, there are indications that consumers are becoming weary of purchasing products from influencers and online pitch-people.

Jiajia, a streamer based in Hangzhou who promotes beauty and clothing brands for WPIC Marketing + Technologies, also faces challenges. Her team meticulously analyzes minute-by-minute traffic data to determine the best strategies for capturing attention and driving sales.”

“When e-commerce was in its infancy, purchasing goods was much easier,” Jiajia commented. “However, nowadays, consumers are more rational and have a clear idea of what they want to buy.”

To adapt to these changing consumer behaviors, major e-commerce platforms have also embraced more traditional strategies. They have focused on improving delivery speed, offering automatic coupon collection, providing delivery fee insurance, and guaranteeing the lowest prices. In a significant move, JD.com and Alibaba introduced a price-matching promise, ensuring that shoppers receive a refund for the price difference if a product becomes cheaper after their purchase.

Despite these efforts, the volatile nature of the economy poses a challenge, and the abundance of incentives may still fall short. Prior to the Covid pandemic, events like 618 and Singles’ Day had transformed into online phenomena, with consumers eagerly sharing their most significant finds on social media. Even celebrities like Taylor Swift have participated in these shopping extravaganzas.

The enthusiasm for JD.com’s 618 promotion has significantly diminished during the Covid era, with merchants feeling alienated due to heavy discounting. Over 50 book publishers in Beijing and Shanghai declined to participate in the promotion, which required substantial discounts of up to 80%. Other merchants have also decided to withdraw from 618 as discounts continued to escalate over the years, according to He from Kearney China.

In recent years, the ecommerce giants have been selectively reporting figures instead of providing overall Gross Merchandise Value (GMV) numbers, due to slower growth. In 2022, JD.com reported its total sales for the festival at 379 billion yuan, which accounted for over 10% of its total GMV for the year.

“The focus is still on lower pricing and best value,” said David Hampstead, CEO of Samarkand Global, a company that assists western brands in selling to Chinese consumers. “However, there is a limit to how much brands can be pushed before China becomes too expensive or not profitable enough to participate. We are reaching that point.”

Assisted by Charlotte Yang, Zheping Huang, and Peter Elstrom.