Colombia aims to increase its oil production to 1 million barrels per day by urging drillers to increase their activity in underutilized exploration areas, according to the country’s top energy official.

In addition, the government is taking steps to boost natural gas production, as projections indicate a potential shortage by early next year, said Mines and Energy Minister Andrés Camacho in an interview.

To achieve these goals, the government plans to incentivize exploration in “lazy contracts” that have seen minimal or no activity since being signed 10 or 15 years ago.

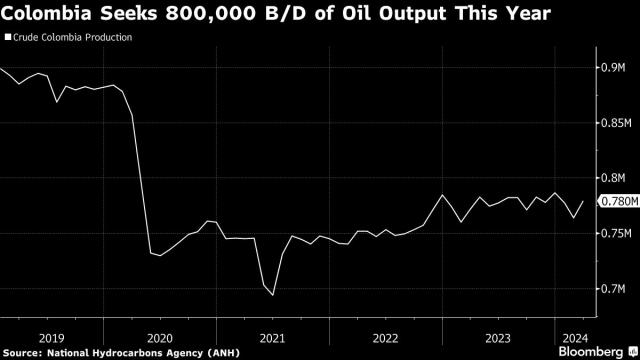

Camacho believes that through these efforts and other measures, Colombia can raise its oil output to approximately 800,000 barrels per day by the end of this year, surpassing the first-quarter average of 774,000 barrels.

President Gustavo Petro, known for his commitment to combating climate change, has declined to sign new drilling licenses, despite the fact that oil and coal contribute to about half of the nation’s exports. Instead, the administration aims to increase the exploitation of existing blocs.

According to Camacho, the government’s strategy focuses on maximizing exploration within the current resources, rather than seeking additional contracts. He emphasized that more contracts do not necessarily equate to increased exploration.

The government, through the National Hydrocarbons Agency, has established a set of requirements that must be fulfilled for each contract. Camacho stated that this agreement was reached with companies and is now being implemented, although it only came into effect at the end of last year.

This approach aims to prevent the practice of companies signing contracts solely to later sell them at a higher price, without utilizing them. Camacho believes that the new requirements will help curb this behavior.

In addition, some requests from companies were approved, such as granting permission for drillers to relocate within the same field, he explained.

Declining Reserves

According to the hydrocarbons agency, natural gas reserves decreased to the equivalent of 6.1 years of production at the end of last year, compared to 7.2 years in 2022. Proven crude reserves also declined, reaching the equivalent of 7.1 years of output, down from 7.5 years in the previous evaluation.

Government estimates indicate that Colombia’s natural gas supply will fall short of demand by the beginning of 2025, and imports will be necessary to fill the gap until deep water deposits become operational, which is expected to happen in 2027 at the earliest. However, Camacho is optimistic that initiatives such as the resumption of suspended contracts will help narrow the gap.

According to Camacho, the availability of offshore gas will ensure a stable supply in the medium and long term. The government is currently working on removing social and environmental obstacles to make existing contracts commercially viable.

In terms of exploration, Ecopetrol has entered into an agreement with Parex Resources Inc. to explore in Casanare in the eastern plains. Additionally, efforts are being made to increase gas production in the northern Cesar province, near the Caribbean coast.

Colombia has also made regulatory changes to allow pipelines to transport both oil and gas. This will enable fields that previously couldn’t bring their gas to market to now have the necessary infrastructure.

In terms of importing gas, Camacho mentioned that the private liquefied natural gas port in Cartagena, known as SPEC, may be able to increase its regasification capacity by approximately 80 million cubic feet per day as early as this year. This additional fuel would be accessible to all users, not just thermal plants.

Camacho also suggested that importing gas from Venezuela could help address the shortage. However, due to US sanctions on Venezuela and the need to repair the pipeline connecting the two countries, this import option will likely be delayed until around 2026, instead of the initial plan for this year.

Furthermore, Ecopetrol is utilizing enhanced oil recovery techniques to improve extraction volumes from reservoirs, which is also contributing to increased crude oil output. Camacho stated that the recovery factor in Colombia currently averages at 27%, while some countries have achieved over 40%, indicating potential for improvement.