Euro-Zone economic activity reaches one-year high as recovery accelerates

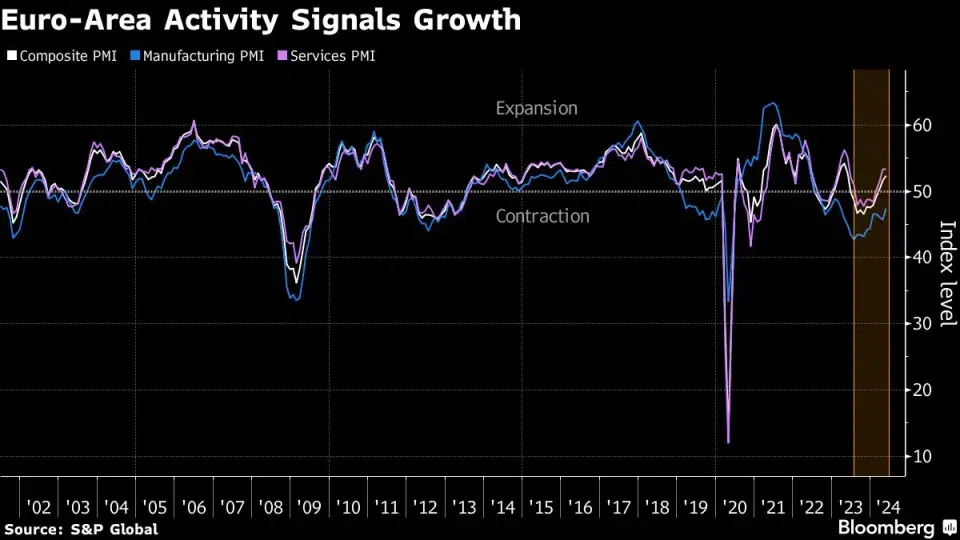

Euro-area private-sector business activity has reached its highest level in a year, indicating that the region’s economic rebound is gaining momentum. S&P Global’s purchasing managers’ index for May rose to 52.3, surpassing analyst predictions and remaining above the 50 threshold that signifies growth for the third consecutive month.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, commented, “This is as good as it gets. The euro zone’s economy is gaining further strength. It is encouraging to see new orders growing at a healthy rate, while companies’ confidence is reflected in steady hiring.”

Germany, Europe’s largest economy, also received positive news, with its reading surpassing expectations and manufacturing making a stronger contribution. However, France unexpectedly slipped back into contraction territory as services underperformed.

According to de la Rubia, although people tend to compare the performance of economies and identify their weaknesses and strengths, the good news is that both economies are moving in sync. This suggests that there is a high possibility for France to catch up in the services sector, which would contribute to the overall growth of the euro-zone economy.

The economic outlook for the 20-nation bloc is improving after experiencing a recession in the latter half of last year. Inflation is approaching the target of 2% and the European Central Bank is set to lower interest rates. The European Commission has stated that the continent is on track for a smooth recovery.

Isabel Schnabel, a member of the ECB Executive Board, has expressed that the economy is gaining momentum, further fueling optimism that the worst of the crisis has passed.

According to an interview with German broadcaster ARD, there is a slight revival in the euro area economy. The interviewee expressed optimism that the economy will return to price stability without experiencing a recession, as inflation continues to decline. However, this growth conceals a prolonged slump in the industrial sector, particularly in Germany. The country has been affected by weak global demand and the increase in energy prices following Russia’s invasion of Ukraine. Nonetheless, S&P Global predicts that the euro area may see GDP growth of 0.3% in the current quarter, matching the previous three months.

There were indications that consumer prices could hinder the ECB’s plan to reduce rates this year. S&P highlighted the services sector as the main driver of inflation, noting that input costs were rising rapidly.

ECB Vice President Luis de Guindos acknowledged that price growth may fluctuate in the short term before reaching a sustainable level of 2% in 2025. While a quarter-point rate cut next month seems reasonable, he cautioned against making further decisions without carefully considering the evolving economic data.

Speaking in an interview with Oberösterreichische Nachrichten, Guindos emphasized the high level of uncertainty and stated that no decisions have been made regarding the number or size of interest rate cuts. The ECB will closely monitor the development of economic indicators before taking any further actions.

As an editor of financial articles, I possess a comprehensive understanding of the economic landscape, market trends, and financial policies. I am adept at analyzing and interpreting complex information, including company financial statements and stock transaction data. With a keen eye on global financial trends and monetary policy shifts, I am always up-to-date with the latest industry developments.

My writing style is concise, clear, and objective, allowing me to effectively convey intricate concepts in a reader-friendly manner. I have a strong logical thinking ability and data analysis skills, enabling me to present information rigorously and accurately. With a heightened sense of news sensitivity, I am able to identify and report on relevant events promptly.

In particular, I recognize the significance of Purchasing Managers’ Index (PMI) reports, which are eagerly anticipated by the markets due to their early release in the month. PMIs serve as reliable indicators of economic trends and turning points. While these business surveys primarily measure the breadth of changes in output rather than the depth, it can be challenging to directly align them with quarterly GDP figures.