On Tuesday, Nvidia (NVDA) stock broke new ground, trading above $1,100 for the first time ever. This surge allowed shares to surpass their previous record closing high, with the day ending above $1,140.

Hess shareholders approve merger with Chevron

According to initial voting results, Hess Corp has approved its $53 billion merger with Chevron, the second-largest oil company in the United States. The merger required a majority vote from the outstanding 308 million shares of Hess to pass

Stock market today: Nvidia, Nasdaq reach record highs as AI rally continues

The Nasdaq Composite, which is heavily weighted towards technology stocks, hit a new milestone on Tuesday, surpassing 17,000 for the first time. This was driven by the impressive performance of AI company Nvidia, which reached a record high of $1,140 per share after its earnings report.

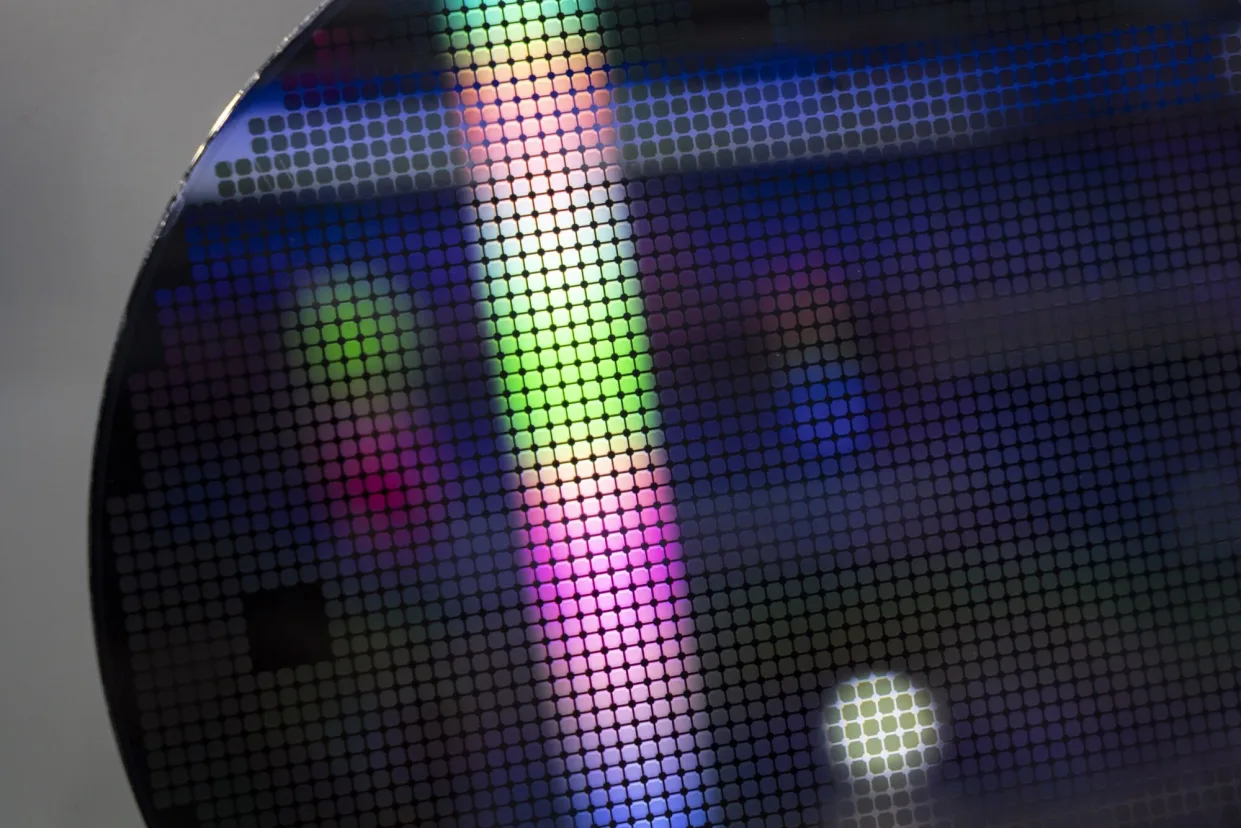

China Creates $47.5 Billion Chip Fund to Back Nation’s Firms

China has established the largest semiconductor investment fund in the country’s history, aiming to boost the development of the domestic chip industry. This move comes as Beijing strives for self-sufficiency in response to the US’s efforts to limit its growth.

Extreme Heat Will Stifle US Economy, Fed Study Says

A recent study conducted by the Federal Reserve Bank of San Francisco predicts that extreme heat will have a negative impact on the US economy. The study highlights that the construction sector, which contributes significantly to the country’s economic output and employs a large number of outdoor workers, will be particularly vulnerable.

Nasdaq closes above 17,000; S&P 500 slightly higher, Dow down

The Nasdaq achieved a historic milestone on Tuesday, surpassing 17,000 for the first time ever. This achievement was driven by the strong performance of Nvidia, which saw a 7% increase in its stock price. This positive momentum also benefited other chip stocks, leading to a 1.9% rise in the semiconductor index.

Japan’s First Nuclear Transition Bond Attracts Solid Demand

Kyushu Electric Power Co. has successfully raised ¥30 billion ($191 million) through Japan’s first environmental bond dedicated to financing nuclear projects. Despite the controversial nature of the deal, the power company received strong demand from investors.

China Quants Saw Assets Shrink After Stock Meltdown Hit Returns

China’s quantitative hedge funds experienced a decrease in assets last quarter for the first time since late 2022. The drop in assets was a result of the stock-market meltdown in China, which impacted the performance of these funds and eroded investor confidence in their algorithm-driven trading strategies.