According to President Christine Lagarde and Chief Economist Philip Lane of the European Central Bank (ECB), there is still not enough evidence to suggest that inflation threats have subsided. This has led to expectations that the ECB will refrain from cutting interest rates this month.

Lagarde stated that with a robust job market in the euro-zone, the ECB has the luxury of time to assess incoming information. Speaking to Bloomberg TV, Lane added that the inflation reading for June alone will not provide a comprehensive evaluation of services prices, which are closely monitored.

Lagarde expressed that there are still uncertainties surrounding future inflation, particularly in terms of how profits, wages, and productivity will develop, as well as the possibility of new supply-side shocks impacting the economy. She emphasized that it will take time to gather sufficient data to determine if the risks of inflation exceeding the target have diminished.

The comments suggest a preference for maintaining borrowing costs at the upcoming ECB meeting this month. Investors have been eagerly awaiting indications from Lagarde on the pace of rate cuts since the initial cut in June, as well as whether the political situation in her home country will influence monetary policy.

In her speech on Monday, Lagarde does not mention France and does not provide specific guidance on the future path of the ECB. Instead, she emphasizes her commitment to making decisions based on incoming data.

Lagarde states, “The strong labor market allows us to take the time to gather new information, but we must also be aware of the uncertain growth outlook. This reinforces our determination to rely on data and make policy decisions on a meeting-by-meeting basis.”

For more information on the Sintra conference: ECB Gathers With France’s Election Drama Overshadowing Rate Cuts.

Lagarde emphasized that the ECB’s assessment of inflation is not solely based on their projections, but also considers other factors. This contradicts analysts’ speculation that rate changes will only occur during quarterly meetings when new forecasts are available.

She also made it clear that policymakers will not be swayed by any single piece of information. She has previously acknowledged that reaching the 2% inflation target will not be a smooth journey and may involve temporary setbacks.

Lagarde stated, “While new information continuously improves our understanding of medium-term inflation, we are not influenced by specific data points. Being data dependent does not mean relying on individual data points.”

In terms of expectations for interest rate cuts, Lithuania’s Gediminas Simkus aligns with the view that two more cuts may occur this year if the data evolves as anticipated.

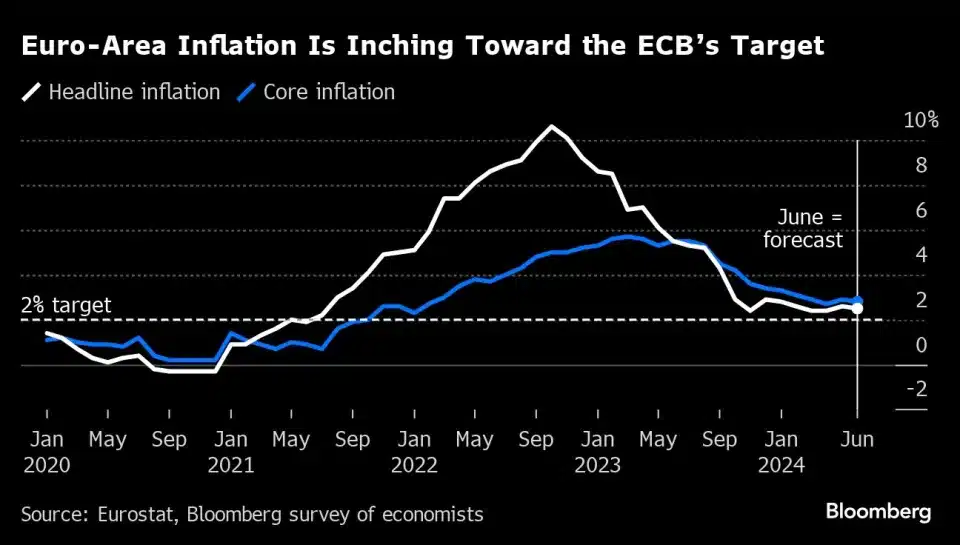

Belgium’s Pierre Wunsch, Estonia’s Madis Muller, and Slovenia’s Bostjan Vasle expressed their views on interest rate cuts in recent interviews. Wunsch stated that the first two rate cuts are relatively easy as long as inflation remains around 2.5%, as it would still indicate a restrictive stance. Muller mentioned that if the actual outcome aligns with their projections, there is a possibility of further reducing policy restrictiveness this year. Vasle also emphasized the importance of data, stating that if everything goes as expected, interest rates can be lowered, but he did not specify a particular timeline. On Tuesday, policymakers will receive an update on June’s price pressures in the euro zone, which may show slight progress towards the 2% target. Economists predict that consumer-price growth will moderate to 2.5% from 2.6%.

Given the current situation, market participants are anticipating the possibility of one or two additional interest rate cuts this year. Finland’s Olli Rehn has deemed this scenario as “reasonable,” but also acknowledged that officials cannot make a definitive commitment to a specific course of action. However, the Bank for International Settlements has cautioned central banks about the potential risks of lowering rates too quickly and reigniting inflation. Christine Lagarde, the head of the European Central Bank, echoes this sentiment and emphasizes the need for continued vigilance. This article has been updated to include quotes from ECB’s Muller and Vasle, with assistance from Marilen Martin.