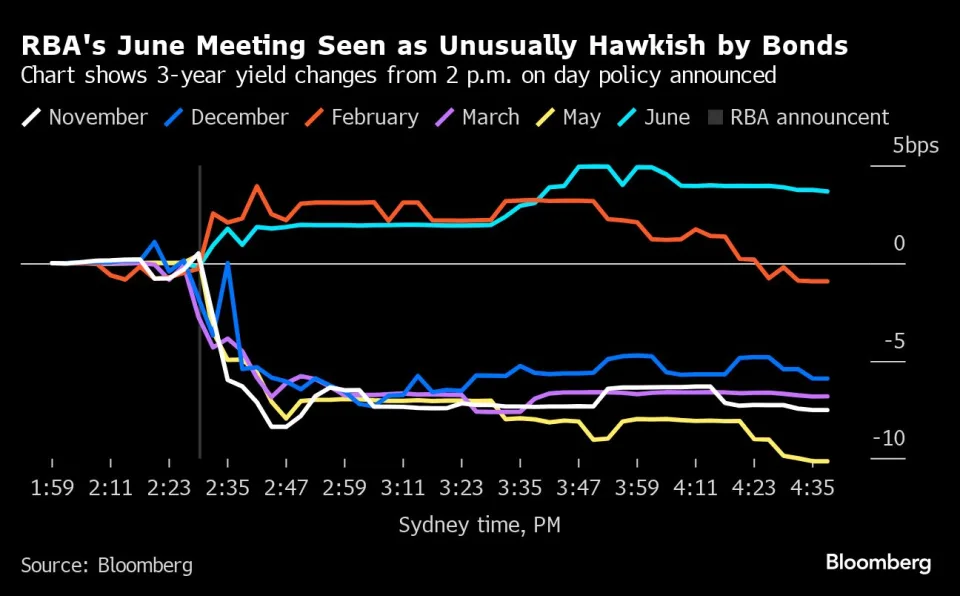

Australia’s central bank has caught the attention of the global market by hinting at the possibility of raising interest rates. This unexpected move has led money markets to adjust their predictions, with a 20% chance now being priced in for a rate hike at the bank’s next meeting in August. The decision to keep borrowing costs unchanged was influenced by the persistence of inflation. Following this announcement, three-year bond yields experienced a significant increase and have remained elevated. This marks the first time since last June that such a reaction has occurred on an RBA meeting day. Australia’s central bank stands out as the only major monetary authority, apart from Japan, that could potentially raise rates at its upcoming gathering.

“The market is still not fully pricing in the risk of a rate increase by the RBA,” said Sean Keane, chief strategist for Asia Pacific at JB Drax Honore. “During the press conference, it was evident that the RBA is more concerned about inflation compared to the previous meeting, and the balance of risks has tilted further towards the need for a tighter monetary policy.”

On Wednesday, yields on three-year government bonds, which are sensitive to policy changes, continued to rise. The rate ended Tuesday 3.7 basis points higher than its level before the policy decision, reaching a peak gain of 5 basis points during Bullock’s press conference. However, this increase is not as significant as the one observed on June 6, 2023, when the yield closed 9 basis points higher.

Bullock has consistently stated that the rate-setting board is not making any definitive decisions, but some economists believe that the RBA is indeed considering the possibility of a rate hike while ruling out a cut. In fact, the governor mentioned that the board discussed the option to increase rates this month, but reducing rates was not considered.

Although economists and money markets still anticipate a future rate decrease, it is not expected to occur until 2025. This would likely make the RBA one of the last major central banks to initiate an easing cycle.

Besa Deda from Westpac Banking Corp stated, “The RBA board seems less confident that inflation is moderating. If concerns about persistent price pressures persist, we believe that the RBA is more likely to maintain the cash rate for a longer period rather than raising it again.”