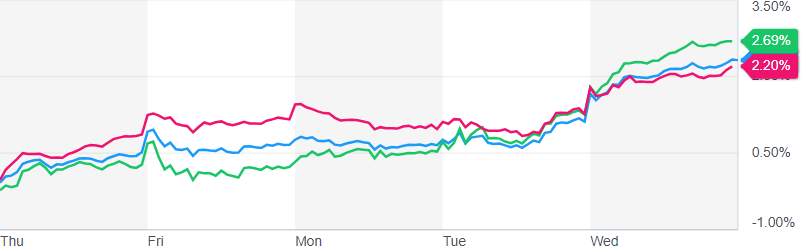

Stocks surged to new records today as the S&P 500 breached 5,300, driven by optimism that the Federal Reserve may cut interest rates sooner than anticipated. The S&P 500 closed at 5,308.18, marking its first-ever close above 5,300. The Dow Jones Industrial Average rose almost 350 points, inching closer to the 40,000 level, while the Nasdaq Composite climbed to another record close, its second in as many days.

The Consumer Price Index showed a 0.3% increase over the previous month and a 3.4% increase over the past year in April, indicating a slowdown from March. This relatively mild inflation reading caused the 10-year Treasury yield to drop to its lowest level in a month and sparked speculation of rate cuts by the Federal Reserve as early as September. According to the CME FedWatch Tool, approximately 70% of traders now expect at least one rate cut by the September meeting, a significant increase from just a week ago.

The stock market has been steadily rising as confidence grows in the strength of the US economy, leading to expectations of a gradual reduction in historically high interest rates. This positive sentiment has reignited bullishness in the market.

In other economic news, retail sales remained stagnant last month, falling short of expectations set by Wall Street.