According to a Bloomberg poll, Turkey’s economy is expected to have grown at a faster pace in the first quarter of the year, driven by strong consumer spending. Despite aggressive interest rate hikes aimed at curbing domestic demand, the economy has remained resilient. The challenge has been to slow down the economy as many Turks advanced their spending ahead of the local elections in March, anticipating a currency devaluation. Inflation concerns have also prompted households to make purchases sooner rather than later. This surge in consumer spending is likely to be a temporary boost before the economy cools down. Analysts predict that Turkey’s gross domestic product increased by 5.8% on an annual basis in the first quarter, compared to 4% in the previous three months.

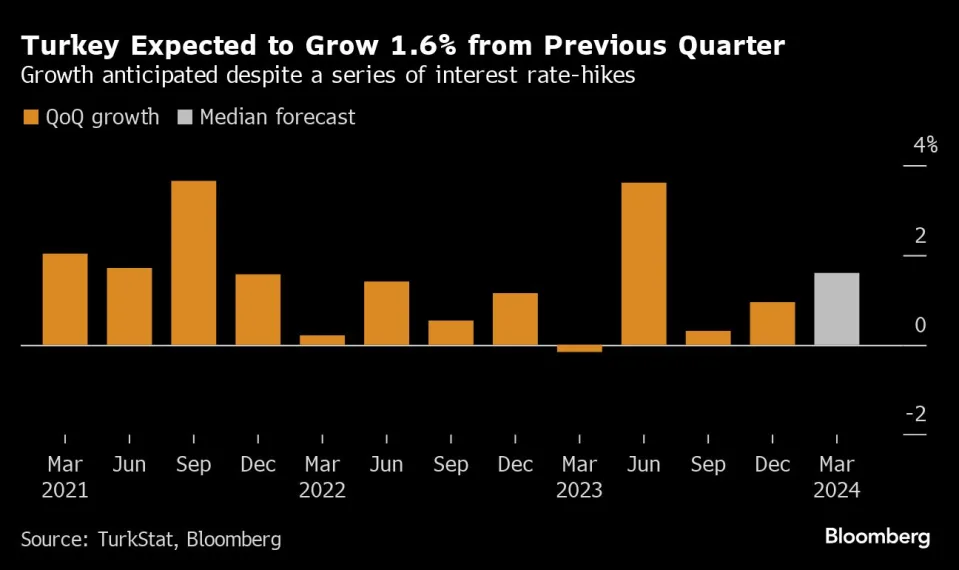

According to a survey, data set to be released on Friday will reveal that Turkey’s GDP growth has increased to 1.6% from the previous quarter, after adjusting for working days and seasonal changes. Consumption plays a significant role in Turkey’s $1.1 trillion economy, accounting for more than half of it.

In a report, economists from Garanti BBVA Research, led by Seda Guler Mert, stated that the slowdown in domestic demand is still limited and that aggregate demand remains stronger than supply.

Despite the central bank raising interest rates nearly sixfold to 50% during a period when growth barely dipped below 4%, the tightening campaign reached its peak at the end of the first quarter.

Despite implementing a relatively generous fiscal policy, the authorities were unable to control the demand for consumer goods and services, which is one of the primary factors contributing to the current inflation rate of about 75%.

Ahead of the municipal elections, the government took measures to alleviate the impact of the high cost of living by raising the minimum wage by 50% at the beginning of the year. According to officials, this decision played a crucial role in supporting household spending and maintaining its resilience.

Bloomberg Economics provides its analysis on the situation, stating that the surge in spending during the first quarter can be attributed to expectations of a significant depreciation of the currency following the March 31 vote. In the month after the May 2023 elections, the lira depreciated by over 20% against the dollar. As a result, households likely accelerated their consumption in the first quarter of 2024 due to concerns of a similar decline in purchasing power after the March vote.